Theranos 2.0 - either the next Tesla or the next ... well, Theranos

This is either the best long idea or (unintentional) best short idea that I will ever publish

~~ setting the scene ~~

As I was telling my wife about this idea over cheese curds at dinner, after explaining what it is (and after her asking me how much I had put into this hair-brained idea), her final question was - “wait, are you short or long?”

So that’s how you know this one will be a fun, brain-damaging one (or for many, one simply worth avoiding). But for the brave, please read on.

_______________________

The company is Talis Biomedical Corporation (symbol: TLIS).

The market cap is currently $146 million.

The enterprise value is currently negative ~$150 million (more on that later).

They are basically trying to do what Theranos did … but appear to be a bit farther along … but there are still a lot of yuge promises of pie in the sky and related risks involved.

_______________________

I somewhat randomly stumbled upon the company last week. Divine (or satanic) intervention? Who knows. But I was quite intrigued and quickly got up to speed over the past few days (at least superficially). And from my bit of research, I believe (and as always, this should be taken as the opposite of advice) that this is definitely worth consideration and perhaps worth a gamble (and it is indeed a gamble).

The company is basically trying to pick up where Theranos, yes, *the* Theranos, left off. They are developing an Edison-like device that is contemplated to be used to enable tests to be performed quickly and at the point of care rather than sent out to centralized labs. The following images are from their investor presentation on their website which summarizes what they aim to achieve:

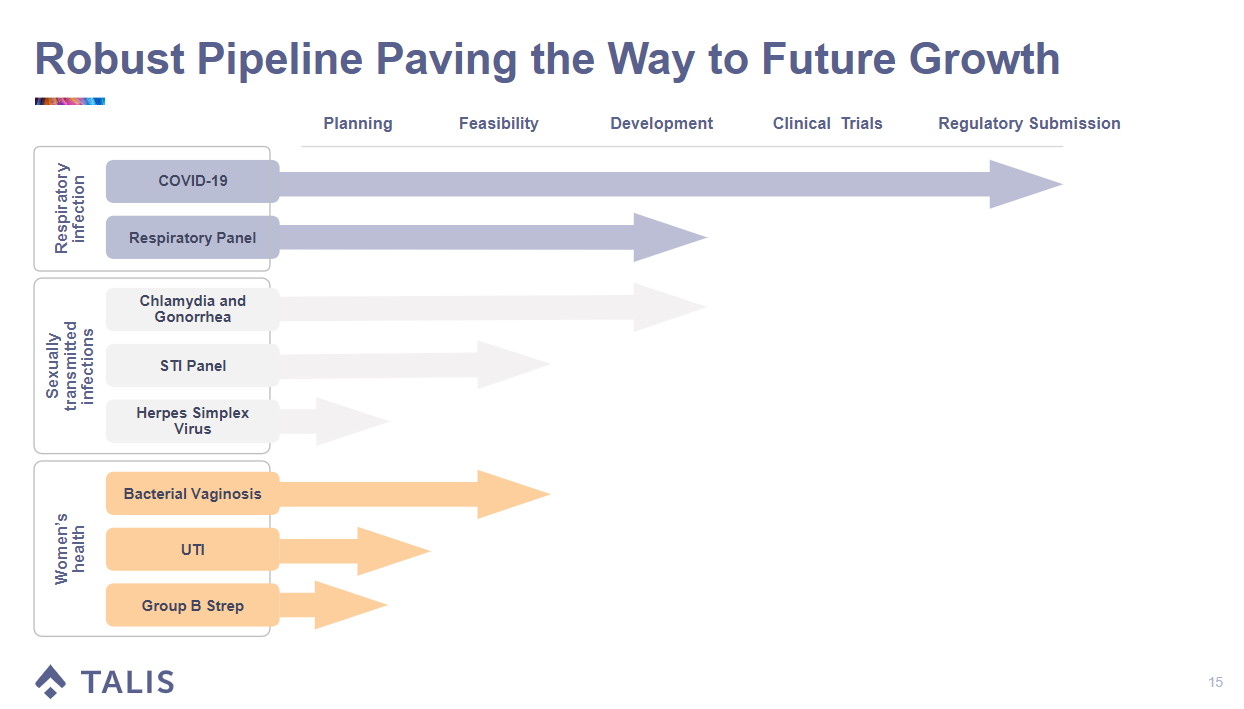

In the spirit of the great Elizabeth Holmes, they are hoping to deploy desktop devices that can run (eventually) a variety of tests at the point of care/test (though, different from Edison, they plan to use different cartridges containing different sampling mediums and reagents, which to this untrained eye seems slightly more accomplishable than doing every test under the sun from a single drop of blood) which will enable rapid testing for many end uses - COVID-19 (and its variants) is a particular and the initial focus, but they are aiming to have far more numerous end uses, including STI and women’s health tests.

So now, taking a step back to how we got to where we are today -

Long before I was aware of this company, they IPO’d in early 2021 during the peak of the “third wave” of COVID in the United States. Shares priced at $16, which resulted in proceeds of ~$200 million to the company. The market received the offering with initial fanfare given the relevant end use (COVID testing) - shares traded as high as $33 on its first day, before sinking to its IPO price within a month, before further declining (to be explained a bit further below) to its current ~$6/share.

Thanks to the IPO proceeds as well as prior cash on hand, the Company’s balance sheet is robust - at 6/30/21, the company had $313 million of cash on hand and a net stockholder’s equity of $293 million (thus the negative $150 million enterprise value vs. the current market cap of just under $150 million as teased in the intro).

But, there’s a reason why shares are cheap - not only is the company aiming for the stars, but their aim appears to be off - they are behind schedule on the expected milestones vs. their S-1 and earlier guidance. They do now have an EUA application in with the FDA, which was submitted on July 23rd (from the Q2 earnings call transcript):

So, that’s a pretty good thing. But it’s now been 3 months and no updates. I’m not a biotech expert (or hobbyist or novice) so candidly, I do not know if the timing should be read in any type of way - but the company has projected confidence that the product works for this end use and it is just a matter of time for the application to work its way through the regulatory approval system.

So, the 30,000 foot, I’ve-looked-at-this-company-for-5-hours-and-committed-a few hundred basis points-of-my-Ally-account-to-this thesis:

The technology, if it works, is a game-changer (as Theranos’ would have been - and again, we know how that all turned out). Specifically as it comes to COVID, rapid point-of-test PCR results would enable society to function more normally as we live in a world of endemic COVID rather than acute, lockdown, pandemic COVID. Testing could be done at airports, walk-in sites, doctor offices and clinics, and more, providing actionable results (~30 minutes) that are much faster and more useful than current PCR turnaround times (still generally 24 hours to multiple days in the US).

Further to the point above, the company is developing a combination COVID/flu test which management has totally sold me on as being a major game-changer. As we do transition to endemic COVID vs. pandemic COVID (as well as a likely resurgence of the normal flu), it will be critical to differentiate between the two which can often have similar symptoms. At an airport, at a 5,000 person factory or office, at larger schools - it will be critical to be able to tell if someone’s sniffles are related to a contagion with a 2% mortality rate or one with a de minimis mortality rate. Below is management’s commentary on the Q2-21 conference call regarding this combined panel and its uses, and again, they totally have me sold.

And of course, if the technology inherently works for COVID, and then the flu, then the other contemplated end uses seem to become a bit more possible, and the sky becomes the limit.

Of course, the caveat is once again, that just like Theranos, the tech may not have caught up to the idea. It seems promising here that this is fairly fully-baked based on the EUA submission (which involves hard data) that the tests work for COVID … but they have yet to receive approval, so who knows. Then, of course, they will actually have to sell these machines - 1.5 years into the COVID-19 pandemic, testing infrastructure has improved (though is still far from great), and it may be a harder sell now to deploy these machines when better existing processes are in place now than may have been the case twelve or six months ago.

So with that brief overview, and all of the related caveats, I think that the valuation, general setup, story, and chart make this an interesting opportunity for someone who loves big risks.

As noted, shares trade at a negative enterprise value and at about 50% of cash on hand (there are 26 million shares outstanding and cash on hand of over $300 million, or about $11/share vs. the current ~$6 share price). To be fair, the Company is burning cash - but much of the recent cash burn was to prepare for the hopeful near-term commercialization of its device - actual burn may be something more like $100-$150 million/year (that is my extremely back of the envelope guestimate), so they’ve got some time and runway to make this work and shares trade at a fairly large discount to pack-it-in liquidation value. If they ended Q2 with $300m and change on hand, I’d expect Q3 to be ~$250m, still very much higher than the current market cap.

The float is small, shares are closely held, and there is meaningful short interest. The float (according to Yahoo Finance - take it with a grain of salt but your favorite substack author is not of the Bloomberg terminal-owning class) is 8 million shares. Also per Yahoo Finance, 1.4 million shares appear to be shorted. Recently, there have been only ~100,000 shares traded per day - so there will be some burn-shorty juice if and when the headlines flip from negative to positive. Additionally, amongst the longs, there are large and generally well-regarded holders (who mostly bought in at IPO) - the famed Baker Brothers own 30% of the company.

From a chart-astrology angle, shares appear to be bottoming out here in the high $5’s. Over the past few weeks, the prior meltdown appears to have mellowed or ceased and the share price has stabilized. That is heartening for considering initiating a position - the falling knife appears to have hit the kitchen floor, at least for now.

In my opinion (and this is a very 2021 way to think of the market so perhaps I have had a bit too much of the kool-aid) there are multiple mental price targets if and when things turnaround and the news flow improves. First, there is cash value/neutral enterprise value at around $11, or nearly a double from today’s prices. Then there is the IPO price of $16. Then, if there’s some real traction, there is of course the all-time highs around $30. And then if this really works… no need to even discuss that possibility.

And on a related note, the market cap is just incredibly low compared to both future potential as well as just in general. $150 million is nothing, especially in the 2021 crazy yolo nothing matters idea-based market. If these tests work, and the COVID use is approved, the total addressable market, even in just the US, is many, many, many times the current value of the company. There’s not that many companies where you could say “this could be worth 10x as much as it is today and still make sense”, but I think we have that here (of course, if things actually work out operationally).

So how to play it, for those interested in potentially rolling the dice?

As always, this is not advice -

I own shares as well as February $12.5 calls. I think there is a margin of safety in the shares due to the cash balance (which in no way prevents them from falling further if milestones are missed, regulatory approval is rejected, etc.). I like the February $12.5s due to the mental price targets noted above - if things go well and shares go back to the IPO price of $16, my Feb $12.5s bought at $0.30 will be worth $3.5+, or 10x, vs. a 3x increase in the underlying. If things go really right, and the stock gets hot, that leverage obviously further juices returns. At this point I would say that I have put on about a 1/2 position and will be adding over the coming days to bump that up a bit further and will retain a bit of mental commitment on the sidelines if shares do continue to slide lower prior to any real reason for them to.

So in conclusion, I think this is a coin flip with asymmetrical returns - if the Company is indeed the next Theranos in the bad way, it probably farts around here for a while (in the $4s/$5s or even $3s) and one might lose 50% on an equity investment. If the EUA is granted, I think this could quickly trade back to cash (a 2x) or the IPO price (a 3x) or beyond. In the long term, if the science here really, truly works, it indeed may make Elizabeth Holmes’ dreams come true and could be worth many, many times what it is today.

For the risk-averse, this one is probably not for you. For my fellow baggies, this one could be fun.

Truly,

Elmer

Now compute the market cap with the correct number of shares as listed in the filings (55 million)

Well, Marx said that history repeats itself, first as tragedy, second as farce.